March Income Report and April Budget

We switched the budget just about every 3 days this month. Most of the moving was due to the fact that I kept forgetting yearly and bi-yearly bills we have. I didn’t realize just how much we spend each year on insurance. I don’t think that is bad because we do need it, but I think we need to start doing some shopping around in the next couple months to be sure we have the best prices.

If you remember our budget plan for Feb we had a pretty good chunk to go toward our loans and it is slowly getting chipped away as we have implemented these bills into our budget. I am not going to lie, this is extremely frustrating for me. I have this crazy detest and anxiety when it comes to debt. It is a huge stressor for me, so something like this only makes me feel like we are NEVER going to make it if we don’t have more money.

I know this is crazy! I know we dug this whole and I don’t expect to pay it off tomorrow, although this would be nice, but sometimes it feels like we will NEVER get to the point of paying it off and having money to do what we want. I also thought it would be way easier for me to live this tightly of a budget because we have done it for so long. But after 10 years of living this way, I am starting to feel the stress of just not having money.

I am ready to have money to do what we want and because we made the choice to go into debt we can’t do it yet. This is added stress on everything. We are in discussion of what we can do to still pay loans but give us some relief from the stress to make it bearable. I don’t know what we will end up with, but I think this is a need for us to make it.

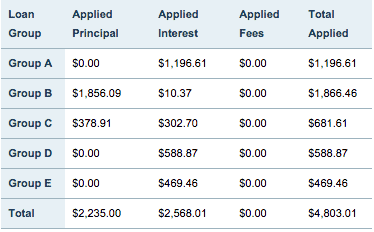

Last month we paid a little less on loans then the last couple months. We did this because of the changes in our budget, but we also did it because we are putting a little less of my income toward the loans. We paid $4,803.01 total across the 5 loans.

As you can see we split up the payment into 2 groups this time. We did this because we paid off our group B loan!!!!!!! I am so excited to have 1 loan done! It is a great relief, but at the same time, we are moving on to a loan that will take us at least a year to pay off.

When we made the payment, I realized that the entire thing went to paying interest on our loans. a friend of mine told me about an article she read which said to pay the minimum payment and then call in and ask them to do a separate payment just on the principal amount.

I am still not sure if this will work, but I am going to try that next month to see if it works. If it does, we should be able to pay off our loans faster, but it will mean more work for me and more to track to be sure it happens.

I also found out that if you sign up for automatic payments your interest rate will be lowered by .25% on each loan. We are thinking about doing that if it works to do 2 payments in a month. that way one payment will be off my plate and we will be able to get less interest which means less total paid.

I am still learning here and working out what works for us. This is taking me much longer than I ever thought it would and I am finding myself even more frazzled than I was during school. It is a bit annoying, but I keep telling myself that once we find what works it will all calm down and we will be much happier in the end.

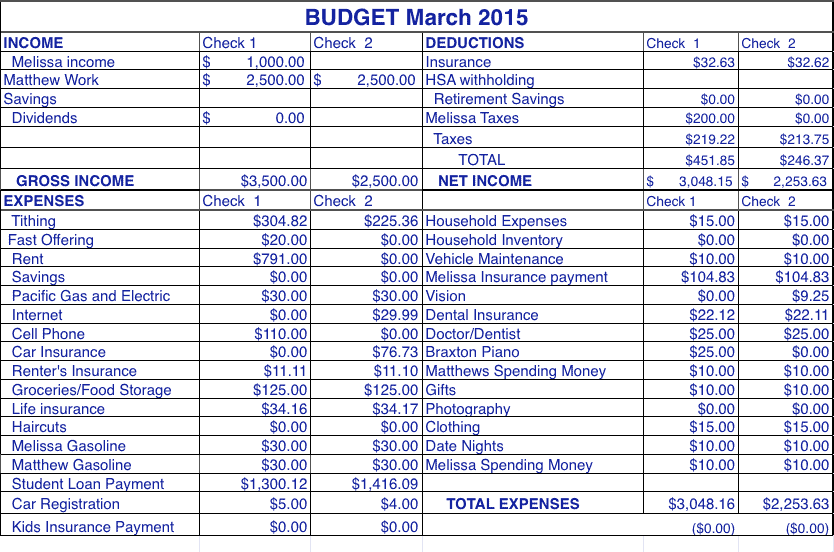

April 2015 Budget

This month we are hoping our budget has hit a spot of solidifying for the most part. I need to remember to get the cash envelopes funded so I am better at tracking my spending. This has been a bit hard for me.

Here is the budget for this month:

How is budgeting going for you? What suggestions do you have for us in paying off our loans while saving our sanity?

have you considered cutting your cell phone? I got rid of mine. Think of the fun you could have with that $110 a month!! 🙂

I would love to do that, but both Matthew and I use it for work. That is the main reason we have it. But I didn’t have one until 4 years ago and I loved not having one. It was nice to disconnect!

Can you find a less expensive place to live? Do you have kids? Maybe you could babysit other peoples kids to bring in extra money and maybe there is a less expensive cell phone plan? There is always a way to bring in more income or save, but it’s up to you to think about and find the way. You can do it!