January Debt Pay off and February Budget

1 month down and I am excited!!!!!! I know you were hoping for part 2 of our story, but you will have to wait another week for that one! (insert evil laugh here) Seriously though, it is coming so don’t disappear on me!

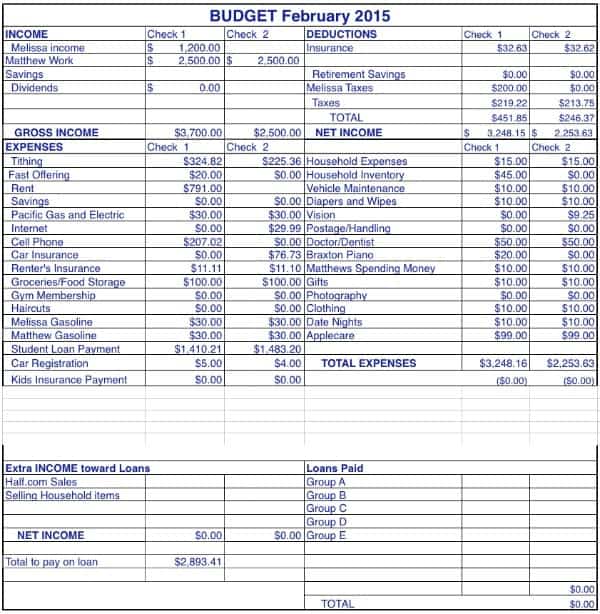

We did a lot of moving stuff around in the last month. We have been able to get some things we weren’t expecting to get yet, so we had to rework the budget.

This is the first time we have ever had a bi weekly pay check so we are learning how to budget when you don’t get everything in 1 day for the whole month. It is kind of difficult, I am not going to lie. Do you split up your bills between the 2 checks or do you do a little from each check?

I don’t think there is a right or wrong in that one, but I do think that we are going to have to do a little trial and error experimenting to figure out what works best for us. I think I am more of a split it between checks type of person. But we will see.

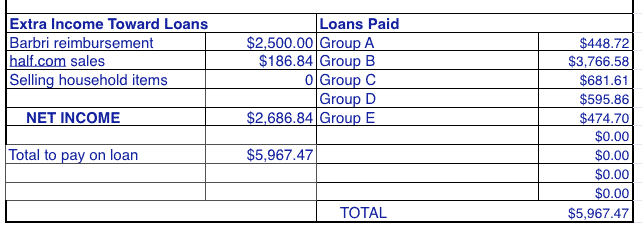

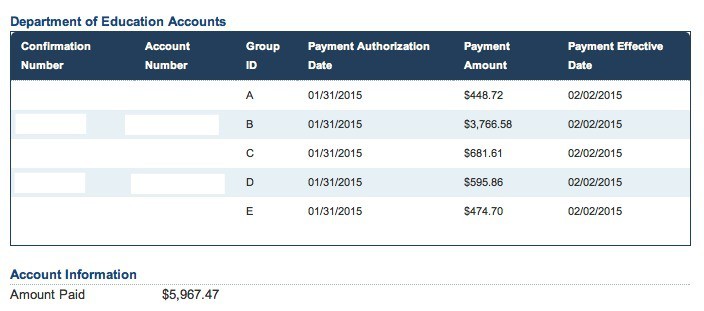

So we made a payment on our debt! It was a lot more then we thought! Because we are working hard to get extra money each month to pay on our debt I had to make a separate section of our budget just for the extra money on our loans. I worked it so I could calculate the total payment we would make at the end of our month so I don’t have to do that at the end of the month. If you want me to share that I can, just let me know in the comments. But without any further suspense for you, here is how much we paid.

Are you as shocked as I was? Almost $6,000 paid off! This picture shows our minimum payments on our other loans and the rest put onto our smallest loan. If we are able to put as much on the loan this month it will almost be paid off. I can’t wait!!!

I was a bit scared making the payment. I was worried we wouldn’t have enough money to live off of this month. but now I see that is totally silly because we have had even more coming in and more blessings coming.

So from our budget last month we had $3280.63 from our budget this last month and this was our extra income.

My husband paid a lot of money for a study program for the bar. His school told all the students that if they passed the first time they would get a portion of their fee refunded for the study session. We were not expecting to get that until next month, but we got it early! So we were able to dump all of that money into our debt payment.

We also sold a couple books on half.com that we were able to include in the payment. We still have lots on there so we hope that will continue this month.

We are also continuing to sell items from our house. We have a couple shelves and a desk that need to sell so we are going to be working on those getting sold this month too.

February Budget Plan

So this month we are spending more money then last month. We are starting to fund some things we have never done before. Like Matthew and I are going to each have $20 a month for us.

I am using mine for a once a week dance class on Thursday evenings. He is going to use his for whatever he wants. We feel this is important because we were both so stressed for the last 3 years that we need some money to decompress. This is sanity money for us. we are not budgeting a lot. for him it is only a couple lunches at work or something like that, but It is important to have that time for him and for me.

We also got new phones. Our plan was up with Sprint and the service isn’t great here in Fresno so we decided to switch service. Matthew gets a $50 reimbursement from his work for his cell phone since he uses it for work at times. So we decided to go with Verizon since it is the most reliable in the area and he needs that for work. so this month we will be getting applecare and paying taxes on our phone.

So here is our budget for this month. I am hoping we sell a lot more items so we can put more toward the loans this month. I love how much progress we made last month and while I know that can’t happen next month, I still want to keep up the momentum.

Groceries – I know this is going to be a huge question for people, how do we get our amount so low. I learned a few things from my many years of couponing. I don’t use a lot of coupons for food. But I have learned to cook from scratch, use substitutions and to be very frugal in how I shop. I am going to be adjusting this a bit to find our sweet spot, but for now that is where it will stay.

We split up our gasoline on the budget because I find it easier to track our totals when it was split. This is another section that we are working to find the sweet spot for. We will be adjusting it back together if we feel it doesn’t work.

One Comment