Debt Free Living: Ka’ea’s Story

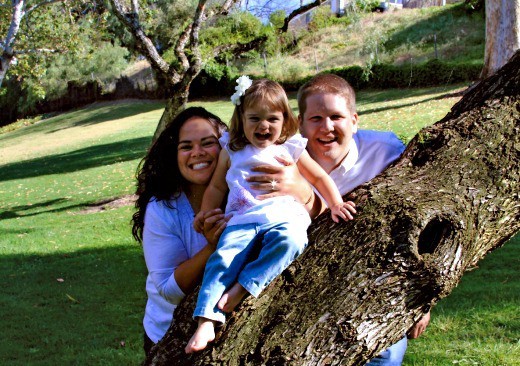

Ke’ea is a long time friend of mine who I consider one of the most deep thinking people I know. She is always thinking about what others are saying and taking it to heart. I love that about her. I feel like she has the true change of heart that it takes to get out of debt, so I asked her to share her story with you today on how that change came to be and how her family has completely changed to be who they are today. They are some of the best examples of living the Lords way and showing that it truly does make you happy. Here is her story:

Not too long ago my husband and I were in debt. We had about $1000 credit card balance, about a $15,000 car loan and about a $10,000 student loan. We thought we were fine. We had manageable monthly payments and didn’t care how long those payments were going to continue. We had discussed ways of budgeting and trying to get out of debt faster, but we were never really successful. Things changed for us , or maybe we changed one night when I went to a function at my church. On this particular evening, Melissa Earl, author of this blog, gave a workshop on being frugal . Another friend at the activity lent a book to me; it was Dave Ramsey’s Total Money Makeover.

While I was at church that night, a light bulb went on in my mind – let’s just sell our car. We purchased the car about a year earlier and had previously paid down $5000 on the loan balance. But the idea of selling the car and being free from the monthly payment sounded fabulous even though it meant eating the $5,000 we had paid on it. I brought this idea to my husband. We agreed that we should go forward with it and do everything we could do to get out of debt as quickly as possible. We knew that as we tried to do our best to get out of debt, God would help us and miracles could happen. My husband began reading Dave Ramsey’s book and he loved what he was reading. He started listening to Dave Ramsey’s radio show and shared things he was learning with me. We were both fired up about attacking our debt and being “gazelles.”

Everyone knows that money doesn’t grow on trees. The power to really wipe out our debt came from taking on extra work to supplement our income. My husband took a second job remodeling a house with a family member. He worked a few hours each evening after putting in 8 hours at his day job plus all day on Saturdays. I hardly saw him for ten months straight. Meanwhile, I had my hands full working as an apartment manager (in exchange for reduced rent) and raising our young daughter. As if this wasn’t enough, we started up a small property management company and oversaw maintenance and rent collection at nearby properties. The income from these extra jobs allowed us to pay off our credit cards and student loan and pay cash for a low-mileage, used car that we liked even better than the brand new car we had just sold. Things worked out much better for us than we could have dreamed. I cannot describe the weight that was lifted when we were finally able to say “we don’t owe anything to anybody.” Interest, which works 24 hours a day, 7 days a week is now working on our savings, and not our debt. As Dave Ramsey puts it, we have changed our family tree.

Ka’ea and her husband and daughter live in Southern CA where they manage apartments, work hard and are making miracles happen each day. If she can do it, so can you!